2020 China's Steel Import & Export and 2021 Year’s Forward

The year of 2020 is a very special year for all industries around the world.

In the steel industry, whether from the production end or the downstream demand end has been affected by unprecedented.

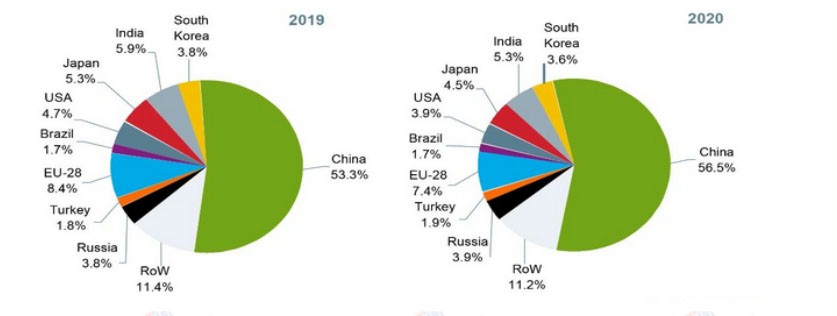

According to the statistics of the World Iron and Steel Association, global crude steel output will still decline 0.9% to 1.864 billion tons in 2020, under the premise of 5.2% crude steel output growth in China, 1.5% in the CIS region and 6.0% in Turkey.

The decline in crude steel production is mainly concentrated in the European Union (-11.8%), South America (-8.4%) and Oceania (-1.4%).

With crude steel production falling, huge quantities of cheap resources are circulating around the world because of the collapse in demand, with most of them going to China.

Figure 1: Global crude steel production distribution (unit: %)

Figure 1: Global crude steel production distribution (unit: %)

l China's Steel Imports & Exports Situation in 2020

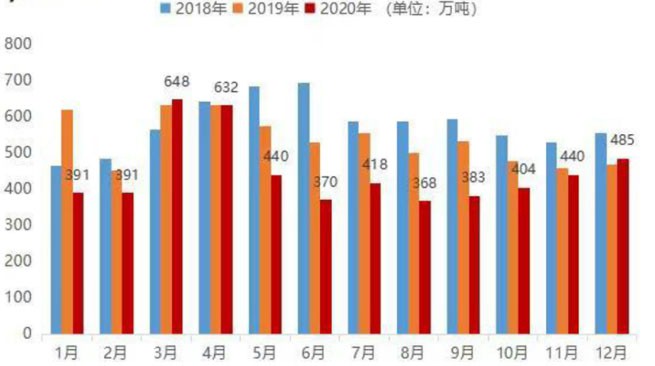

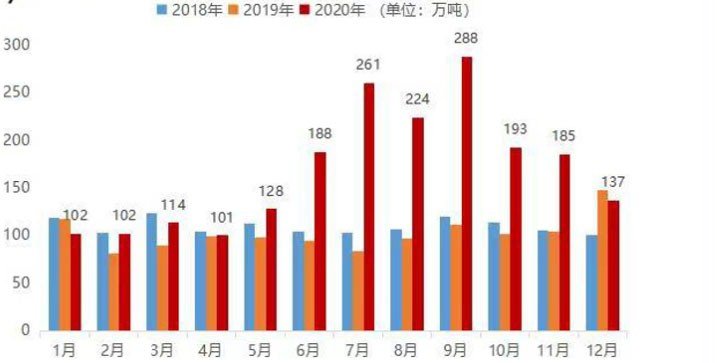

In December 2020, China's steel export of 4.85 million tons;Total exports from January to December amounted to 53.677 million tons; That is 10.674 million tons less than the same period in 2019.In December 2020, steel imports totaled 1.374 million tons; Accumulated imports from January to December totaled 20.233 million tons; An increase of 7.931 million tons over the same period in 2019;The annual net export of steel in 2020 was 33.44 million tons.

Figure 2: China's steel export volume (unit: 10,000 tons)

Fi

Fi

Figure 3: China's steel imports (unit: 10,000 tons)

As can be seen from Figure 2 and Figure 3, the export volume of Chinese steel began to drop dramatically in May, and the import volume began to increase in June.

According to the 1.5 to 2 months 'shipping time of steel international trade, the epidemic coincided with the overseas outbreak time node. In the case of a sharp drop in overseas demand and price, the epidemic had a huge impact on China's steel import and export.

In December 2020, the import of plate is 1.018 million tons; Total imports from January to December amounted to 16.085 million tons; That is an increase of 5.764 million tons over the same period in 2019.December of 2020, plate export 3.028 million tons; Total export from January to December amounted to 32.725 million tons;5.773 million tons less than the same period in 2019;In 2020, the annual net export of plates was 16.64 million tons.

As the major type of China's steel exports, plate products will be exported 32.72 million tons in 2020, a year-on-year decrease of 5.77 million tons. Imports amounted to 16.08 million tons, an increase of 5.76 million tons over the same period last year. The importing 16.08 millions tons which it is increased for 5.76 millions tons ,net exports amounted to 16.64 million tons, which translated into an increase of 11.53 million tons from exports to domestic sales.

The above data are only affected by direct export, we have learned, affected by the epidemic overseas in 2020, Japan and South Korea, Europe, the United States and other regions downstream (cars, home appliances, shipbuilding, etc.) there are more than 60% of the mass production production have shutdown , at the same time accumulate in 1 ~ 3 epidemic areas of Hubei province where manufacturing industry total shutdown. And the part and components export reduction caused by plate type of indirect exports have also suffered a big blow.Global steel sheet prices began to drop dramatically from April, with the emergence of low-cost resources. Traders in the Chinese market, which took the lead in recovering to normal, began to purchase a large number of hot coil, medium plate and semi-finished products. In June, the imported resources began to arrive, and the import volume rose in a blowout.

l Price comparison of global mainstream varieties

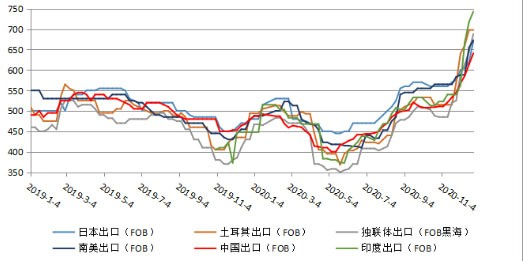

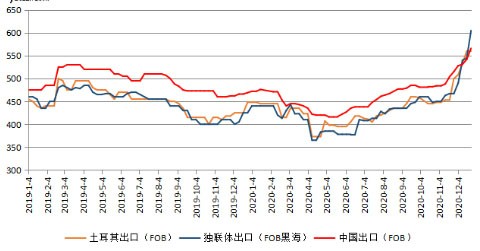

From the perspective of global price trend, the competitiveness of China's hot coil export price has been low since 2019, which also leads to the continuous decline of steel export from May 2019 to the end of the year.

In 2020, the price of Chinese steel plummeted in January to February, and the export price competitiveness was highlighted.

In March, the one month export volume hit a highest level in 3 years amount .

Later, due to the collapse of overseas prices, China's prices picked up, steel exports once again into the doldrums.

Figure 4: Global hot coil price action summary (USD/ton)

Figure 5: Export prices of rebar by major countries (unit: USD/ton)

In terms of rebar steel, the price of Chinese rebar steel has been at a high level in the international market. In addition to the direct supply and export volume of overseas projects of central enterprises and state-owned enterprises, single type export has not been satisfactory in recent years.

In January 2021, when overseas raw materials such as scrap steel and billet skyrocketed, rebar steel also rose sharply.

In January, China signed export orders for nearly 300,000 tons of rebar steel, and the export of long timber is expected to warm up in 2021.

The main reasons for the reversal of imports and exports in 2020.

l Rapid recovery of domestic demand supports steel imports.

The value of China's imports and exports in goods trade reached a record high of 32.16 trillion RMB in 2020, up 1.9 percent from 2019, according to data released by the General Administration of Customs on January 14.Exports accounted for 17.93 trillion RMB, an increase of 4%;Imports were 14.23 trillion RMB, down 0.7%;The trade surplus was 3.7 trillion RMB, an increase of 27.4%.

In terms of the global situation, according to the latest Global Economic Outlook Report released by IMF, the global economy is predicted to shrink by 3.5% in 2020, which means that the global GDP will drop from US $87.75 trillion in 2019 to US $84.68 trillion in 2020, a direct reduction of US $3.07 trillion, equivalent to the annual GDP of the UK or India.

Under the influence of strong demand and high prices in China's steel market, overseas demand has led to a sharp drop in prices, which has led to a large number of overseas resources being exported to the Chinese market, hitting a 10-year high.

l A large appreciation of the RMB is beneficial to exports

In 2020, the RMB exchange rate against the US dollar will change the two consecutive years of depreciation in 2018 and 2019, and the appreciation rate of the onshore RMB against the US dollar will be close to the level of 2017.On December 31, 2020, the daily closing price of the onshore RMB against the US dollar was 6.539RMB, up 4264 points for the whole year, with an appreciation rate of about 6.71%.

In the case of the continuous appreciation of the RMB, domestic steel mills and traders are under the export pressure, and with the domestic trade prices rise sharply, steel mills are not strong export willingness, and overseas demand continues to weaken under the circumstances, China's steel exports from April to October have appeared a relatively large decline.

On the contrary, due to the appreciation of the RMB to reduce the import cost, most of the original mainstream export traders to find the right time to start the layout of steel imports, and even some of the domestic has never been exposed to the international trade of large and small steel mills are also looking for import channels to follow the trend, so from June to October steel imports have a blowout rise.

l Domestic trade prices have risen sharply, and domestic steel mills have a strong willingness to export to domestic markets

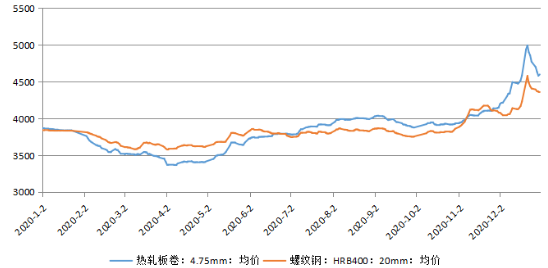

Figure 6: National Average Price of Domestic Trade of Hot Coils and Threads in China (Unit: RMB/ton)

At the beginning of 2020, China's domestic trade prices, which had not been affected by the epidemic, had been running smoothly. Since the end of the New Year holiday in February, prices have gone up against the usual practice and started to fall.

Influenced by large-scale manufacturing shutdown, thread hot coil prices in the way down even began to hang upside down.

Since May, China's demand began to return to normal, and the price went up sharply. However, the outbreak of the epidemic abroad caused the price to plummet, and China's steel export competitiveness lost.

In the case of poor export profit, domestic steel mills and traders have a strong willingness to export to domestic market. This phenomenon can be reflected in the export volume from May to October.

Beginning in November, overseas manufacturing and construction industries were forced to resume work and demand was renewed. Prices of raw materials and finished materials bottomed out and rebounded. China's exports picked up while imports cooled.

l Significant reduction in overseas demand during the epidemic

In the middle of 2020, the terminal manufacturing industries in the main target countries of China's steel exports (Japan and South Korea, the European Union, Southeast Asia, etc.) have been appeared the largely stopped production situation .

Taking Japan and South Korea as an example, the production rate of Japanese and South Korean auto companies is as high as 70%. Hyundai Kia, the largest auto company in South Korea, has completely stopped production, resulting in a significant reduction in the demand for sheet steel. At the same time, auto parts companies led by Hubei Province have also suffered a huge blow, and indirect export of steel has also been greatly affected.

At the same time, the construction industry temporarily shut down, also caused a certain degree of impact on China's long timber exports.

Several factors affecting steel import and export in the future.

l Release of scrap steel imports

On December 31, 2020, the Ministry of Ecology and Environment and other five ministries and commissions jointly issued a notice, according to the State Administration for Market Regulation (Standardization Administration) approved and published on December 14, 2020 "recycled steel raw materials" (GB/T 39733-2020) national standard, as of January 1, 2021.

Since January 1, 2021, the standard recycled steel raw materials do not belong to solid waste and it can be freely imported.

Baowu Iron & Steel Group announced in early January that it had signed its first contract for the import of scrap steel, with the port of arrival at Shanghai.

As Solar Special Steel known that the price of recycled steel of international have been higher than 50 USD/T than China's domestic price while the recycled steel policy has been opened early .

Baowu this round of 3000 tons of import order as a trial order, the specific price has been kept secret.

As of December 2020 Mitsui was quoted $500 / ton CFR for scrap steel from China, so the deal between Baowu and Mitsui is likely to be publicity oriented.

According to the Jiangsu Shagang heavy waste purchase price of RMB 3,050 / ton (US $472 / ton) during the same period, including 13% VAT, at import parity, the domestic trade price excluding tax is US $409 / ton.

During the same period, the price of HS scrap steel is 45,500 yen/ton FOB Japan, including the port charge of 1,000 yen/ton and the freight charge of 25 dollars/ton, which will reach 466.70 dollars/ton CFR China when exported to China.

In recent years, overseas scrap steel has been continuously reduced in price. At present, the price of H2 scrap steel offered by Japan is 360 USD/ton, which has the advantage of import cost.

According to incomplete statistics of Solar Special Steel International Limited , China has signed another three orders except Baosteel recently:

1.Zhejiang Judong Co., Ltd. signed an agreement with Japan Pinhe Commercial Co., Ltd. to import 2,800 tons of recycled steel raw materials, which is expected to be shipped from Japan in the near future and arrive at domestic ports in early February.

2. Shagang International Trade Co., Ltd. has signed an agreement with Nihon Sakawa to import 3,000 tons of heavy-duty recycled steel raw materials, which is expected to be shipped from Japan in mid to late February and arrive at domestic ports at the end of February.

3.Anshan Iron and Steel Co., Ltd signed an agreement with Sakawa, Japan for the import of 2000 tons of heavy-duty recycled steel raw material, which is expected to be shipped from Japan before the end of February and arrive at Bayuquan in early March.

From the current situation, overseas scrap steel prices began to fall, scrap steel is about to start large-scale imports, if a large number of low-cost scrap resources flow into the Chinese market, or will suppress the price of steel raw materials, lower steel production costs.

At the same time, due to the limited global scrap resources, if the supply imbalance occurs in the United States, Japan and Korea, Turkey, the average purchase price of scrap steel in these regions may move up, the cost of mainstream producers of electric furnace will increase, the price difference between home and abroad may further widen, and the price competitiveness of finished products in China will continue to strengthen.

It is understood that a large steel mill in East China annual scrap consumption is about more than 5 million tons, the relevant personage said that if the price and market goods sufficient, there will be more than half of the scrap through import.

2.The Exchange Rate

According to the current situation, the exchange rate will delay the upward trend in the short term. From the perspective of the US dollar index, the US dollar index may have turned from bull to bear and entered a long downward cycle, but the performance of the US dollar index will not necessarily be too weak in 2021.

The dollar index, after all, measures the relative strength of the currencies of the United States against those of other major advanced economies.

On the one hand, even under the impact of the epidemic, the U.S. economy is growing no slower than other major developed economies., on the other hand, considering the recent U.S. Democratic Party won a majority in the senate, so in 2021, Biden president is expected the government will adopt more forceful epidemic prevention and control measures, more of a massive fiscal stimulus and the relative more prudent monetary policy, which means that American economic performance in 2021 May be stronger than the euro zone, Britain, Japan and other major developed economies.

Therefore, the volatility range of the dollar index in 2021 May be around 84-92, with the central level around 88, and the probability of the dollar index falling below 80 with very hard .

From the perspective of exchange rate, the appreciation of RMB is not good for export trade, but from the end of 2020 to the end of January 2021, the sharp rise in exchange rate although the rise in steel export prices have a certain role, but the overseas marketing demand more in the same time obviously. So the impact of this round of rising exchange rate on steel exports is not obvious.

According to the above forecast results and the recent exchange rate trend of RMB against US dollar, there is a trend of stabilization in the near future, and the impact on steel international trade is not great in the short term.

However, it is still necessary to pay close attention to the global epidemic situation and economic development to avoid capital losses caused by exchange rate.

3. China's Export Tax Rebate Adjustment Issue

Recently, domestic news about tax rebate adjustment appears more frequently. For 2021, China's domestic relevant ministries and commissions still forecast it with growth. At the same time, in the case of controlling carbon emissions, the overall steel production needs to be reduced.

And the rumoured cancellation of the export tax rebate on the market, how much impact will the market have?

We assume three possibilities for analysis:

First of all, we define that the "countries of origin" of global hot coil are mainly in the following countries and regions: Eastern Europe (Russia, Ukraine), Southeast Asia (Vietnam, India), South Africa (Brazil), and East Asia (Japan, South Korea). The hot coil produced in these regions will circulate around the world.

① If the export tax rebate for hot rolling is reduced from 13% to 9%.

If the policy is introduced in this way, it will significantly discourage some foreign investors from speculating in China.

At present, from the mainstream export region and China's price is relatively close to the market, the target region of this part of speculation volume will have a greater impact.

After all, the 4% export rebate is 150-200 RMB /ton, equivalent to about 24-30 US dollars.

It has the effect of reducing competitiveness (mainly affecting exports to Southeast Asia) for companies that have been selling at low prices.

② If hot-rolled exports are reduced from 13% to 0%.

If the policy is introduced in this way, it will affect most export businesses and lead to a sharp rise in the domestic export price. Based on the base price of 4400 RMB/ton, 13% is equivalent to 570 RMB /ton, equivalent to US $80-90.At present, the price difference at home and abroad is slightly lower than 1-2 regions in the world, and the rest are higher. Only some regions that cannot be effectively covered by the "country of origin" can have a small amount of trade (except for hot replacement cold products), and the export possibility of other hot rolled products is low.

③ Keeping it in the same

If it remains unchanged, the supply will be followed by the global recovery in the short term, and the quantity will pick up somewhat. It is expected that it will shrink in the second half of the year and return to the normal level (average monthly export of 600,000-700,000 tons).

• Import & Export Forecast in 2021

From the current epidemic and the recovery of global demand, global steel demand is steadily improving. Since the fourth quarter, China's steel export orders have improved significantly. The export volume of all kinds of steel products from December 2020 to the first quarter of 2021 May increase to varying degrees on a month-on-month basis. Meanwhile, the export price of all kinds of steel products from overseas is rising broadly.

It is estimated that if the global epidemic is effectively controlled in 2021, China's steel exports will recover to 65 million to 70 million tons in 2021, and steel imports will be around 10 million tons.

Thank you for reading .

Welcome you to inquiry !

Solar Special Steel International Limited

Email: ss@solarsteel.cn

Whatsapp /Wechat /Skype :+86 18688633122